Smart Safety Solutions For Insurance Companies

Problems You May Encounter

Solution Overview

We use smart vehicle-mounted equipment and data analysis technology to provide insurance companies with real-time driving behavior monitoring, accident responsibility determination, anti-fraud support and risk prediction to help reduce accident rates, optimize claims processes, improve the ability to accurately price insurance products, and improve customer satisfaction.

Get in TouchKey Problems Solved

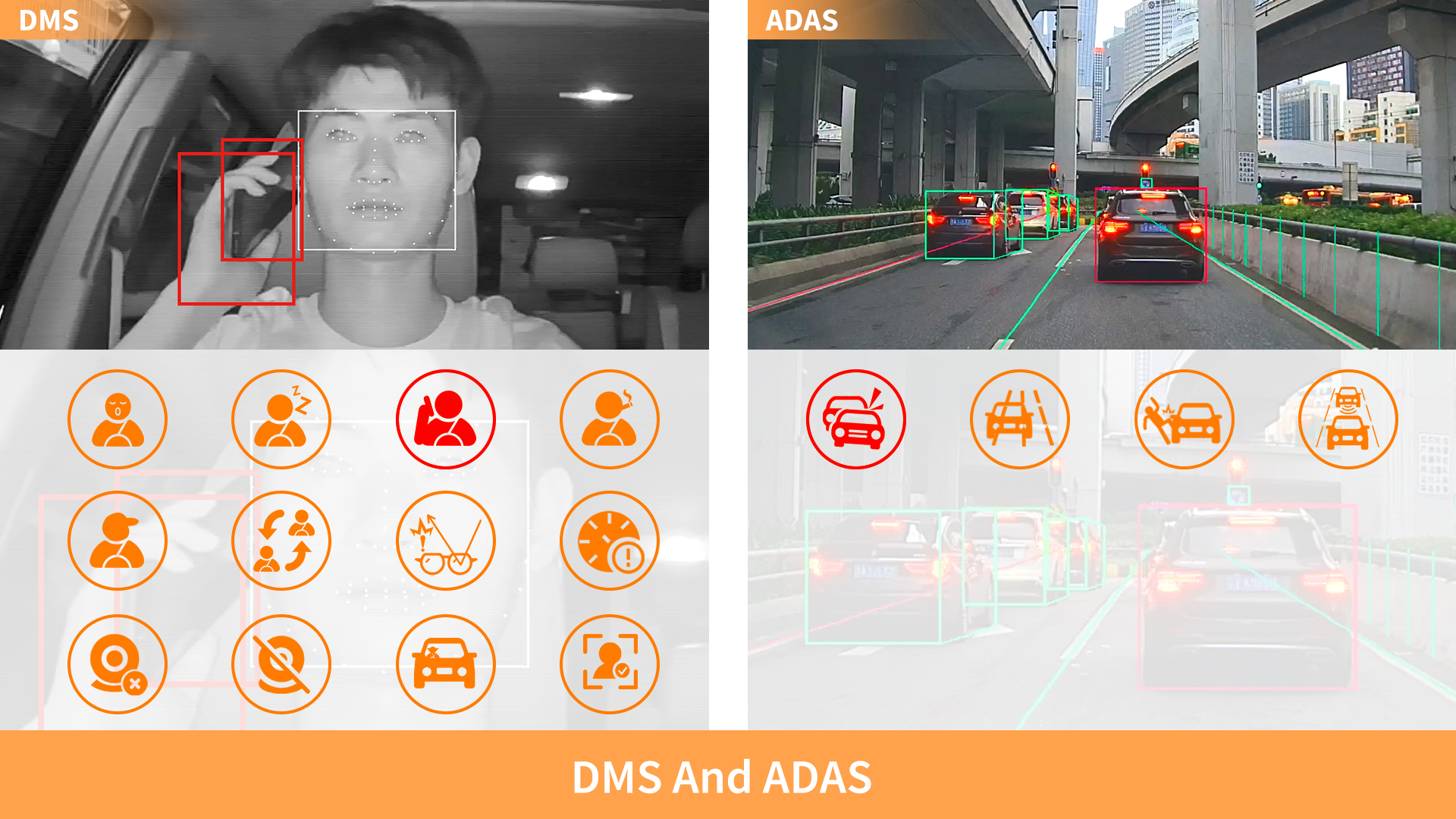

Accurate driving behavior analysis: Traditional insurance pricing makes it difficult to accurately assess the risk level of drivers, which can easily lead to overestimation of risks for high-quality customers and underestimation of risks for low-quality customers. Our AI driving behavior monitoring system uses DMS (Driver Monitoring System) and ADAS (Advanced Driver Assistance System) to record drivers' fatigue, distraction, speeding, emergency braking and other behaviors in real time, providing insurance companies with a more scientific basis for driving risk assessment.

Rapid determination of accident liability: The determination of accident liability during the claims process usually relies on eyewitness testimony or post-investigation, which is prone to disputes. Our vehicle-mounted video surveillance (MDVR) and event recording functions can automatically save video evidence when an accident occurs, helping insurance companies quickly restore the accident process, reduce disputes, and speed up the claims process.

Early warning and prevention of fraudulent behavior: Insurance fraud has always been a difficult problem in the industry, such as forged accidents and deliberate fraud. Our data analysis and AI recognition technology can detect suspicious driving behavior patterns and compare them with historical accident data to help insurance companies identify potential fraud risks and reduce unnecessary claims losses.

Fleet risk management and accident prevention: Insurance companies hope to reduce claims costs by reducing the accident rate, but lack effective real-time warning methods. Our ADAS (Advanced Driver Assistance System), BSD (Blind Spot Detection) and FCW (Forward Collision Warning) systems can alert drivers before an accident occurs, help improve driving habits, reduce accident rates, and reduce insurance claims expenses from the source.

Recommended Solutions

Applicable Customer Types

This solution is suitable for urban freight companies and logistics companies, providing you with digital freight management and prompting drivers to drive safely.

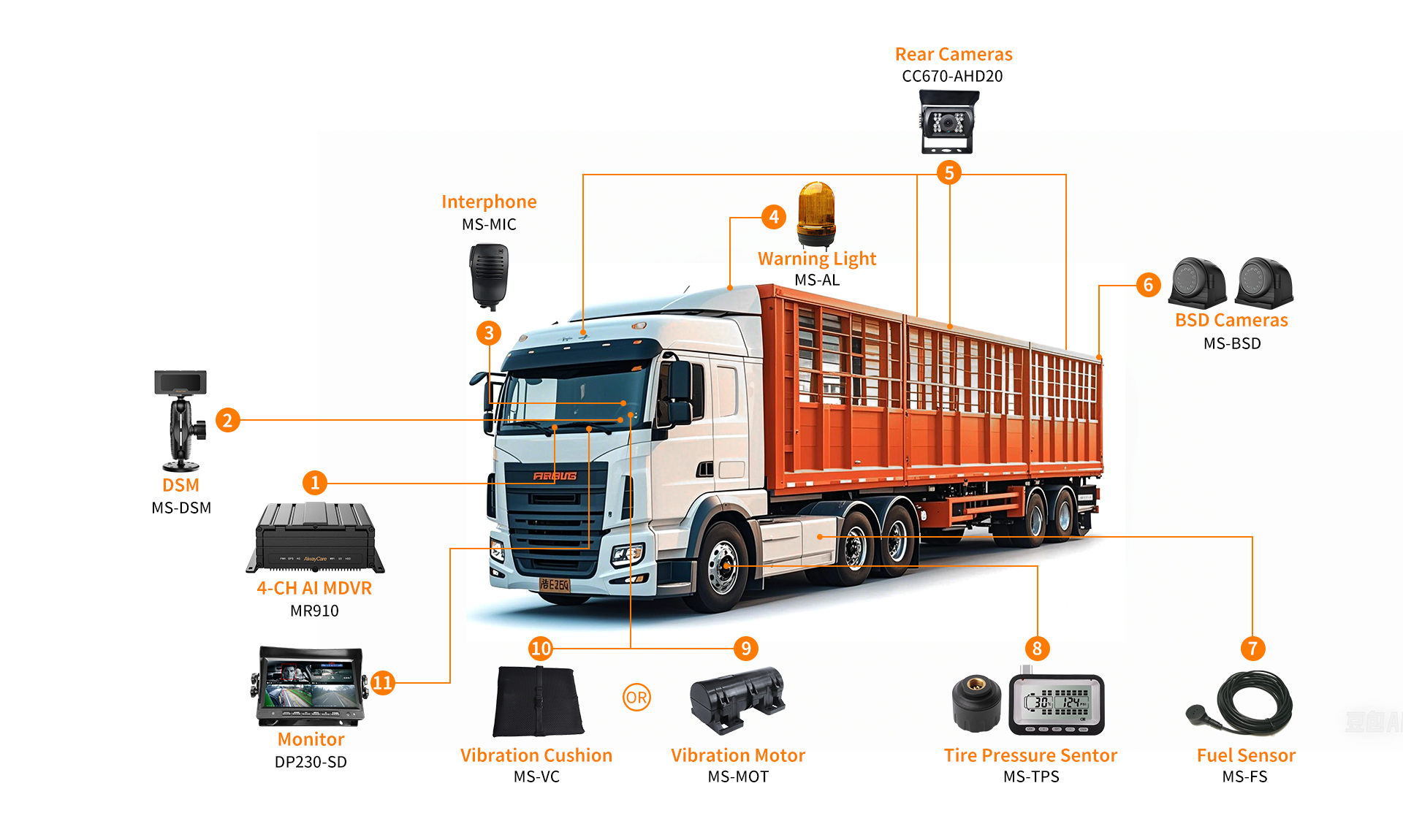

4-channel AI MDVR

Intelligent 4-ch MDVR MR910 integrates powerful Al functions(Driver status monitoring, ADAS,Blind spot detection),Gps positioning, 512GB SD card /4T hard disk storage, 4G remote real-time video monitoring and other advanced functionsto fully protect drivers and vehicles safety and help commercial fleets reduce 95% of accidents.

Applicable Customer Types

This solution is suitable for urban freight companies and logistics companies, providing you with digital freight management and prompting drivers to drive safely.

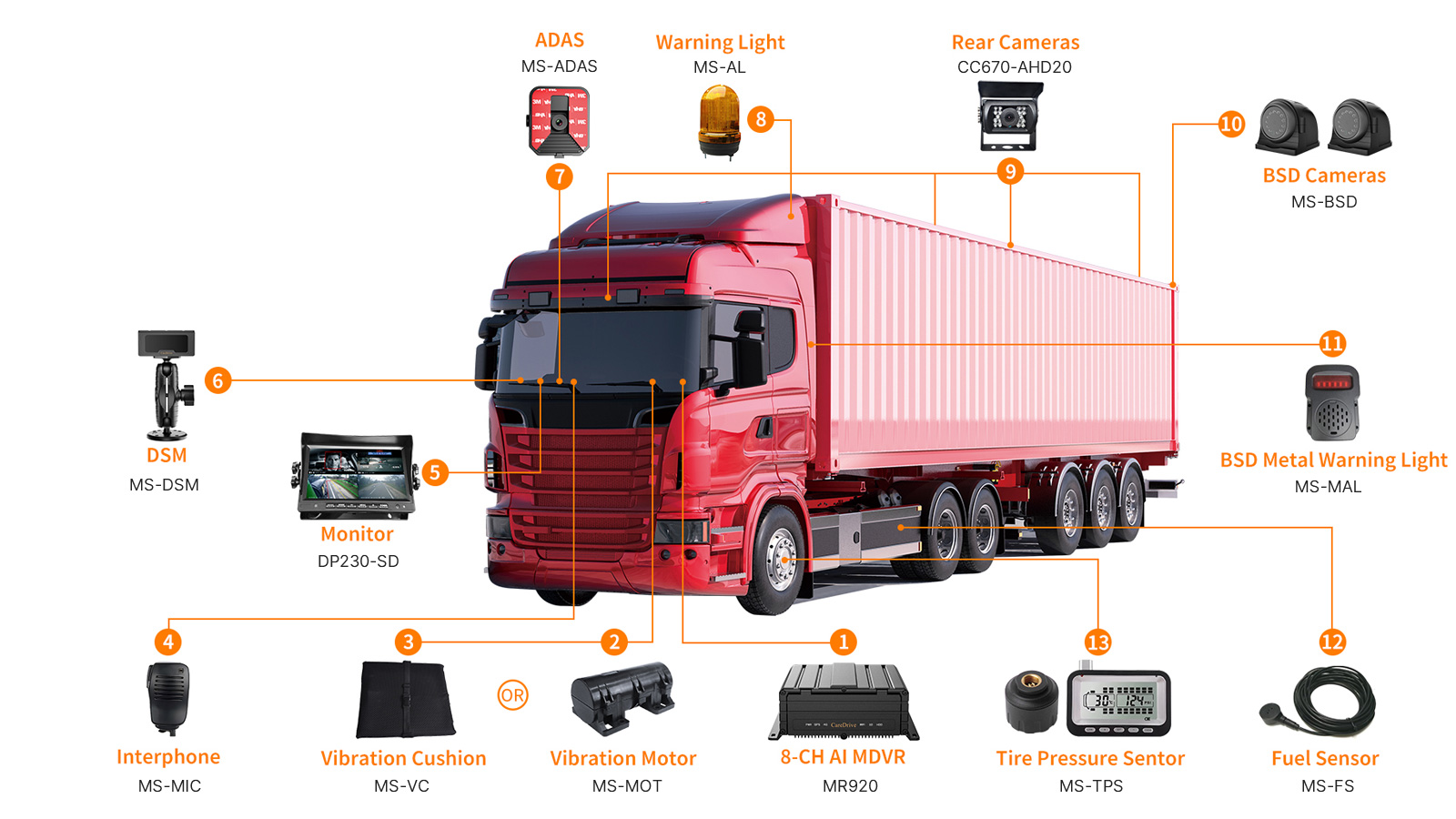

8-channelAI MDVR

Intelligent 8-ch MDVR MR920 integrates powerfulAl functions(Driver status monitoring, ADAS, Blind spot detection),GPs positioning, 512GB SDcard /4T hard disk storage, 4G remote real-timevideo monitoring and other advanced functionsto fully protect drivers and vehicles safety andhelp commercial fleets reduce 95% of accidents.

Customized matching plan

If you have more matching needs, we can customize exclusive product matching solutions for you.

Get a Quote

- Insurance Solutions 1

- *Name

- *Phone

Frequently Asked Questions

- How to prove installation of safety systems for insurance discounts?

Submit device installation certificates purchase invoices or manufacturer documentation typically required for insurer review

- Which vehicle safety devices are recognized by insurers for lowering premiums?

Commonly recognized devices include automatic emergency braking lane keeping assist and adaptive cruise control check with your insurer for specific policy details

- How can installing vehicle safety systems reduce insurance costs?

Equipping safety systems like automatic emergency braking or blind spot monitoring reduces accident risks some insurers offer premium discounts for vehicles with such features

Understand Product Solutions?

We have the latest technology to provide the best solutions for digital safety operation management of fleets. Contact us for a free consultation.

Consult Now

Want to Become Our Distributor?

We provide professional products, expert training, market support and technical support to help you expand the market and create success together!

Become a Distributor

Car Manufacturer Cooperation

We provide professional products, expert training, market support and technical support to help you expand the market and create success together!

Vehicle Manufacturer- *Name

- *Phone

- *Title

- *Content